how do you calculate cash flow to creditors

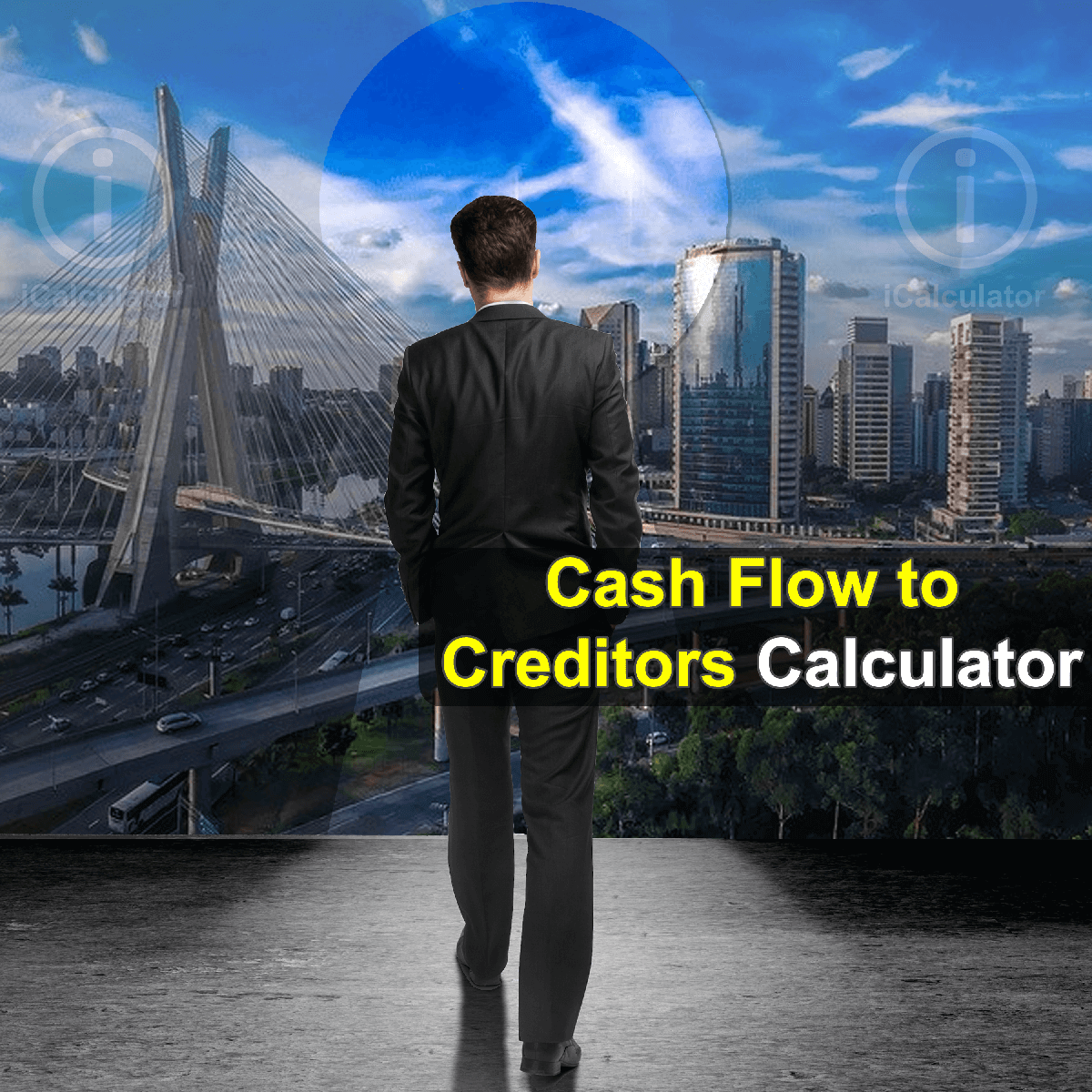

I E B Over here I mean Interest Paid. On the basis of your inputs the calculator will.

How to Prepare a Statement of Cash Flows The operating section of the statement of cash flows can be shown through either the direct method or the indirect method.

. Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures. To calculate investing cash flow add the money received from the sale of assets and any amounts collected on loans and subtract the money spent to buy assets and any. Cost of Sales Total cost of all the products that are sold in a year.

Equation for calculate cash flow to creditors is Cash Flow to Creditors I - E B. Net Cash Flow from Financing Activities. E Ending Long Term Debt.

DCF analyses use future free cash flow. Net Cash Flow from Investing Activities. Use this simple finance cash flow to creditors calculator to calculate cash flow to creditors.

Along with the companys income you have to include the expenses credit payments receipts. Follow these three steps. This is a simple example of.

Calculating the cash flow statement is a lengthy process one which involves several variables. Cash Flow to Creditors Interest Expense. The total capital expenditure amount was 53050.

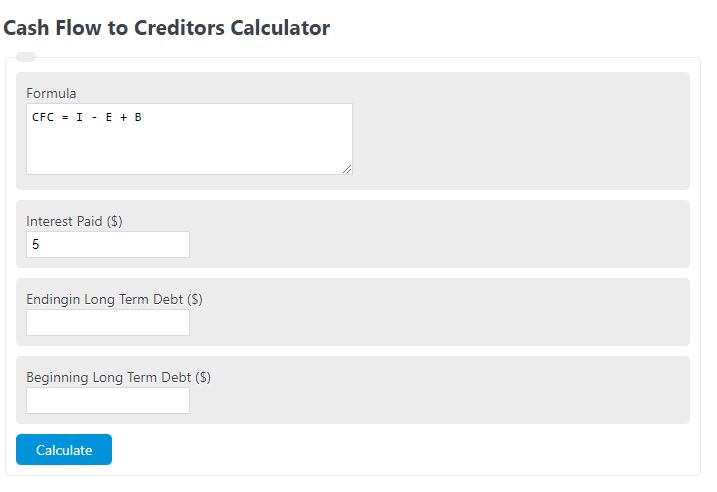

Add the three amounts to determine the cash flow from assets. Learn how companies are getting the most value from working capital in uncertain times. Cash Flow to Creditors is also known as Cash Flow to Bondholders.

Once they have these three numbers Johnson Paper Company can calculate their cash flow from assets. B Beginning Long Term Debt. How to Calculate Cash Flow.

Ad Learn how to get the most value from your working capital by downloading our free eBook. Add the two together to get a total cash balance of 13000. Discounted cash flow DCF is a valuation method used to estimate the attractiveness of an investment opportunity.

As the formula for free cash flow is. The ending period of the long-term debt will. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure Operating Cash.

Take net income from the income statement Add back non-cash expenses Adjust for changes in working capital Cash Flow from Operations vs Net. Cash flow to Creditor Interest paid -. This equation reflects cash flow.

4 Formulas to Use Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities Cash flow. Operating Cash Flow Capital Expenditures Free Cash Flow XYZ Retails formula. Operating Cash Flow is calculated using the formula given below Operating Cash Flow Operating Income Depreciation Amortization Decrease in Working Capital Income Tax.

Heres how this formula would work. CFC I E B Where CFC is the cash flow to creditors I is the total interest paid E is the ending long term debt B is the beginning long term debt Cash Flow From Creditors Definition. Cash Flow to Creditors I - E B.

Calculation of net cash flow can be done as follows. The more free cash flow a company has the. Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance.

How To Calculate Cash Flow To Creditors. The following formula is used to calculate the cash flow to creditors. Your most regular cash expenses will probably be rent and your credit card andor loan payments.

Important cash flow formulas to know about. It is calculated by subtracting Net New Borrowing from the interest payments. Lets see how it is done.

Trade creditors of Payables Enter the yearly payable amount to creditors. Basic Formula The basic formula for operating cash flow is earnings before interest and taxes or EBIT plus depreciation and minus taxes. Cash Flow from Financing Activities Formula 10000 20000 7000 17000 Apple Example Now let us take an example of an organization and see how detailed cash flow from.

E is the Ending of the long-term debt. Where I Interest Paid. How to calculate cash flow to creditors using the calculator The cash flow to creditors calculator uses the following formula.

Cash Flow To Creditors Calculator Finance Calculator Icalculator

Cash Flow To Creditors Calculator Calculator Academy

Cash Flow Statement Overview A Simple Model

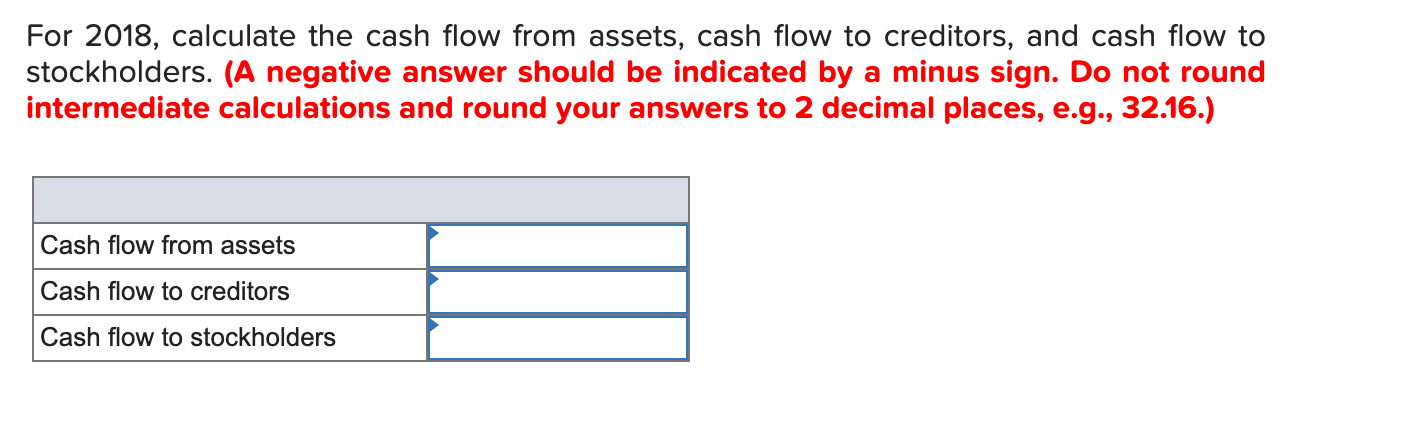

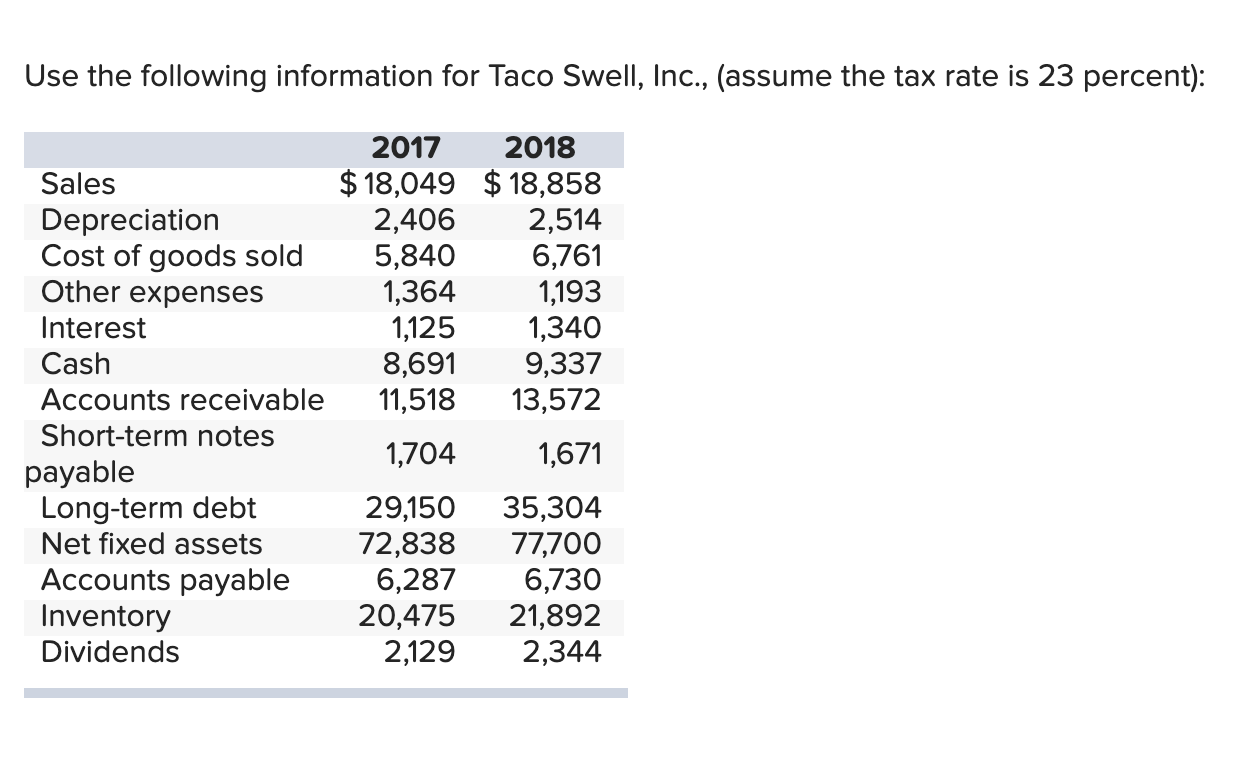

Solved Use The Following Information For Taco Swell Inc Chegg Com

Financial Statements Taxes And Cash Flow Ppt Video Online Download

Cash Flow To Stockholders Calculator Calculator Academy

Modules Guide Creditors Financial Statement Impacts Modano

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

Operating Cash Flow Formula Calculation With Examples

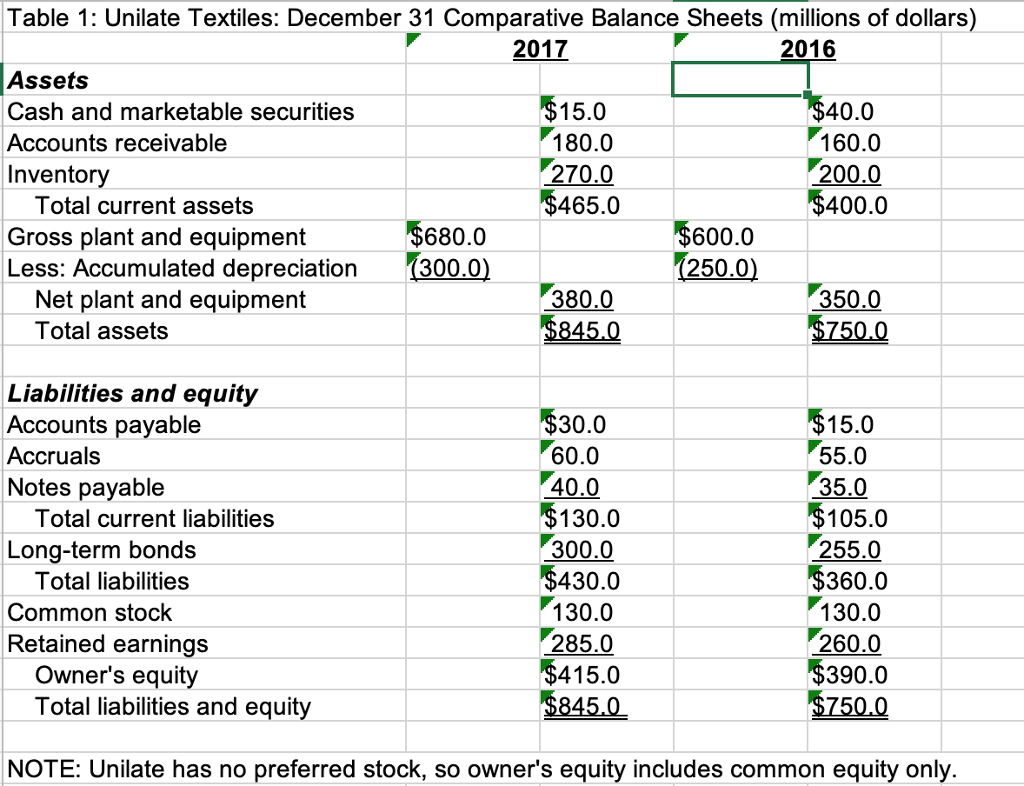

Chapter 2 Financial Statements Taxes And Cash Flow

Solved For 2018 Calculate The Cash Flow From Assets Cash Chegg Com

Solved Calculate The Cash Flow From Assets Cash Flow To Chegg Com

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)